Since the start of the Covid-19 pandemic, consultants Oliver Wyman have tried to cut through the noise to take a research-driven approach to plotting the prospects for travel, tourism and hospitality. As the head of the firm’s Services global practice (which includes leisure and hospitality), Bruno Despujol has overseen this effort. He shares with us some of the latest insights on industry recovery and future opportunities…

In a recent presentation, Oliver Wyman Partner, Bruno Despujol, characterized the situation facing travel and leisure as “the new abnormal”.

Even for a market used to sudden shocks (the SARS outbreak and the global financial crisis being two that are still fresh in the mind), the past 18 months have been seismic. As is the case with any major market disruption, however, there are green shoots of opportunity for those with the ingenuity and daring to take advantage.

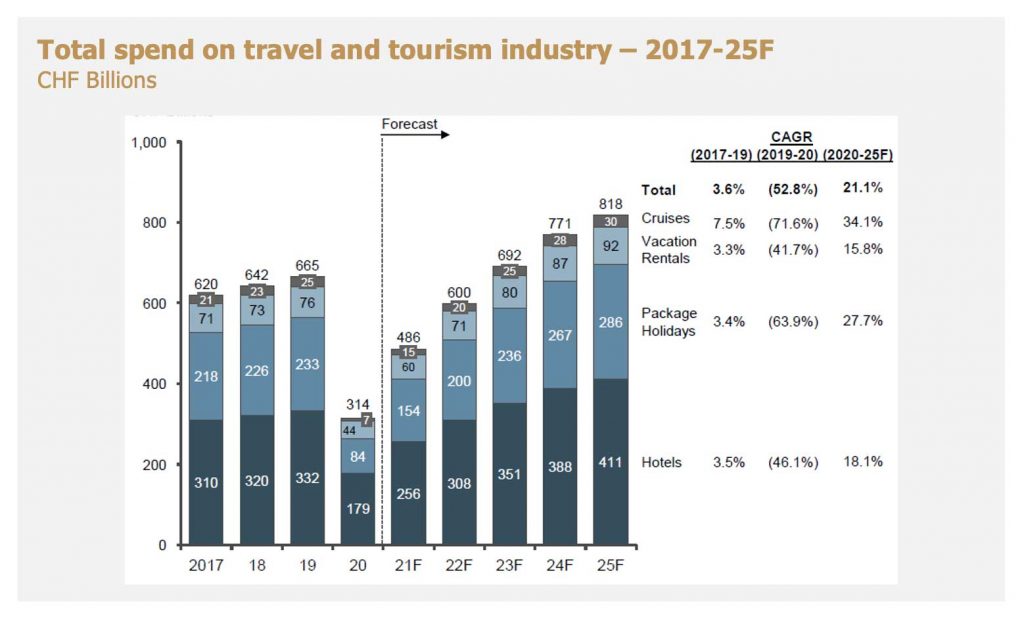

The headline figures, too, make for encouraging reading. Oliver Wyman forecasts global spending on travel and tourism will rebound strongly in the coming years, to the point that it will have exceeded pre-Covid levels by the end of 2023.

Why so optimistic? It’s all in the numbers, as Bruno explains. “Our models are driven by three data sources. First, we look at the impact of vaccines and the progress towards ‘herd immunity’ from Covid. This is a key measure for forecasting any rebound in business and leisure travel, and those numbers are getting better by the day.

“Second, we’ve been running an exclusive survey since the start of the pandemic, called the Travel Sentiment Survey. This gives us oversight of travel intentions in nine key markets, including the United States, China and major markets in Europe. Lastly, the team goes through countless other studies and statistics, which we triangulate with our own findings in order to understand what’s happening at a deeper level.”

Hello, ‘revenge tourism’

What the data are saying is that leisure travel expenditure is set to skyrocket, in a similar fashion to what we saw after SARS and the financial crisis. This time, though, the upward trajectory will be given added impetus by the basic human need to reconnect after months suffering under lockdowns and other liberty-restricting regimes; not to mention the billions in household savings which have accrued in the leading economies, during the period in which there was precious little else to spend money on, outside of grocery home deliveries.

“What we call ‘revenge tourism’ is going to become a very strong factor in the coming months, especially if the vaccine rollout continues to accelerate in Europe and the United States,” says Bruno.

These are (some of) your opportunities

Within this overall market pick-up, Oliver Wyman has identified a series of specific opportunities which are seriously exciting for anyone with an innovative and entrepreneurial mindset, as well as a firm eye on the future.

Among these is the convergence of hospitality and lifestyle – a trend which has already spawned a host of disruptive brands and non-traditional concepts.

“We were seeing the number of brands in hospitality multiplying before the pandemic; now I think people’s hunger for culture, for experience, will play into the hands of lifestyle brands such as W, Mama Shelter, citizenM, Delano and others,” says Bruno.

“When you look at these concepts, they all offer something different. Within Accor, for example, you can go from a hostel model such as Jo&Joe to a more high end offering like a Delano; or a more ‘club’ environment like Mama Shelter. People love to go to these places, even business travelers, because they are fun, and they have nice restaurants and bars.”

Digital drives development

Another major opportunity comes from hospitality’s position at the vanguard of digital transformation.

“What I love about the leisure and hospitality market is that – along with retail – it was the first digital market. So digital is crucial to this business, and will remain so,” says Bruno.

“The next development is that we’re going to witness a ‘mega convergence’ of travel, mobility and leisure. The old segments of business and leisure will also converge, driving the growth of the so-called ‘bleisure’ experience, where business travelers take extended trips incorporating leisure. When surveyed, 75% of them said they were intending to do this.

“We’re also going to see digital technology transforming the customer experience. There will be more personalization, as well as more sophistication to create a seamless end-to-end travel and leisure experience. Consumers are very demanding and every time you introduce friction to your service, you will pay the price.

“I think artificial intelligence (AI) will come into its own for the way it can power efficient personalization. We’ve all seen the story of Netflix with its 80% recommendation acceptance – for me it can be the same story in travel.”

Are you experienced?

Bruno sees the next major frontier in the industry’s digital transformation as being the consolidation of experiences within a seamless, end-to-end hospitality model.

“These ‘downstream activities’ – museums, excursions, theme parks… it’s a huge market, and largely unconsolidated. We’ve seen some destination management companies (DMCs), such as GetYourGuide, start to stake a claim, while Airbnb are also doing good things. However, this is still quite limited compared with the size of the overall market.

“This is not an area that the OTAs want to get into, because adding this type of sophistication creates friction in their models, whereas they prefer to keep things simple. So instead we are going to see specialists emerging to take on this challenge and enrich the market in the process.

“Every time you attach an experience to your trip, it creates something different and adds purpose. And the major ‘win’ for hospitality businesses comes with conversion. For example, I’ve been doing some work recently in the home rentals segment and we found that adding a theme park offer to a rental package multiplied the conversion rate by a factor of four. Here, also, digital can really help, by adding a layer of personalization in terms of the experiences you offer.”

So there is much for the industry to be optimistic – and forward-looking – about. And Bruno had some parting advice to current and prospective Les Roches students who will form the next generation of market players.

“Build your understanding of the new concepts. Even if hospitality is not a high tech market, it is still a very innovative one in terms of its business models, development of people skills and use of digital.”

“The innovation in people skills is perhaps the toughest to get to grips with; but it’s fundamental to the lifestyle segment, where the human interactions and shared interests are so crucial to the offering. One of the big tricks of tourism has always been to surprise and delight the customer – and so much of what I’ve spoken about is ultimately geared towards that core principle.”

· You can hear more from Bruno in our special LinkedIn Live dedicated to the future of hospitality.